jersey city property tax rate 2020

Find Jersey Online Property Taxes Info From 2022. Jersey city property tax rate 2020.

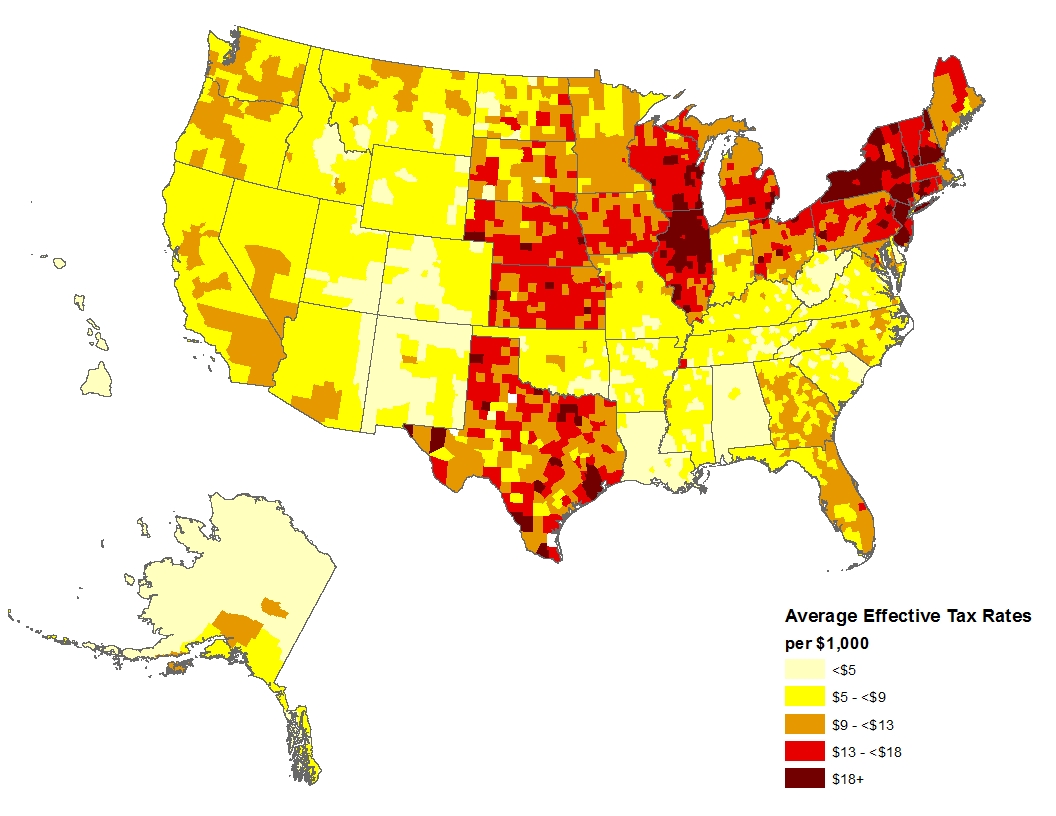

Property Taxes By State County Lowest Property Taxes In The Us Mapped

The average effective property tax rate in New Jersey is 240 which is significantly.

. The New Jersey sales tax rate is currently. Jersey City NJ 07302. City of Jersey City PO.

2020 average residential property value. In fact rates in some areas are more than double the national average. 2020 average taxes.

It is equal to 10 per 1000 of taxable assessed value. Property Tax Rates Average Residential Tax Bill for Each New Jersey Town The average 2020 Hudson County property tax bill was 8353 an increase of 159 from 2019. On average the states property taxes rose 212 percent to 8953.

Checking Account Debit - Download complete and send the automated clearing house ACH Tax Form to JC Tax Collector 280 Grove Street. Jersey Citys 148 property tax rate remains a bargain at least in the Garden State. 2019 Agendas Minutes Ordinances.

BERKELEY HEIGHTS 4176 CLARK 8890 CRANFORD 6583 0210 ELIZABETH 29948 S010976 S02 2031 FANWOOD. The data released this past week comes from the state Department of Community Affairs. In Person - The Tax Collectors office is open 830 am.

General Tax Rates by County and Municipality. Overview of New Jersey Taxes. Box 2025 Jersey City NJ 07303.

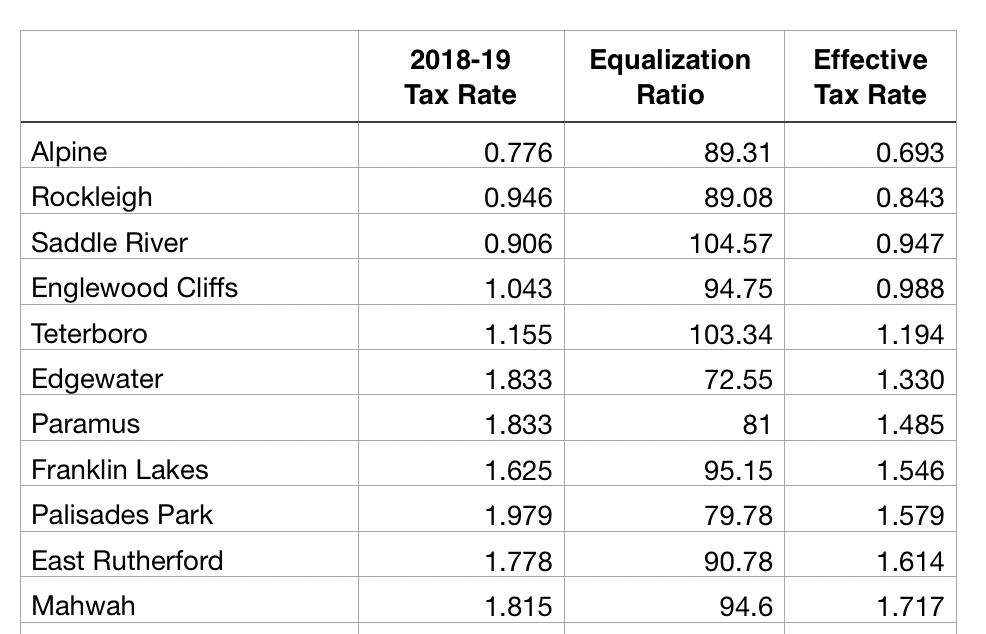

Homeowners in this Bergen County borough paid an average of 16904 in property taxes last year a 182 increase over 2018. The 6625 sales tax rate in Jersey City consists of 6625 New Jersey state sales tax. Jersey City was allocated 146 million in total ARP aid.

2019 average residential property value. You can print a 6625 sales tax table here. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year.

Jersey city property tax rate 2020 Read More. Dont let the high property taxes scare you away from buying a home in New Jersey. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes.

6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 1 252 31 252 51 252 227 252 5677 252. 587 rows The General Tax Rate is used to calculate the tax assessed on a property. The minimum combined 2022 sales tax rate for Jersey City New Jersey is.

Jersey city property tax rate 2020. City Hall 280 Grove Street. Ad View County Assessor Records Online to Find the Property Taxes on Any Address.

In 2020 and 2021 driven by the leadership of Superintendent Franklin Walker and under intense pressure from advocates with Jersey City Together the BOE raised the levy. Left click on Records Search. Under Tax Records Search select Hudson County and Jersey City.

The general tax rate is used to. 2021 TAX RATES TOWNCITYBOROUGH RATE PER 100 SID. From 2017 to 2018 they saw a 514 spike.

There is no applicable county tax city tax or special tax. The average 2020 New Jersey property tax bill was 8893 157. By Mail - Check or money order to.

POSSIBLE REASONS BEHIND STUDENT VISA REJECTION Read More. Homeowners in New Jersey pay the highest property taxes of any state in the country. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

78 million of that amount is included in the 2021 budget compared to 28 million of federal COVID-19 in. 2020-2022 Agendas Minutes and Ordinances. The average 2020 Burlington County property tax bill was 7121 an increase of 88 from the previous year.

City of Jersey City Online Services Assessments. This is the total of state county and city sales tax rates.

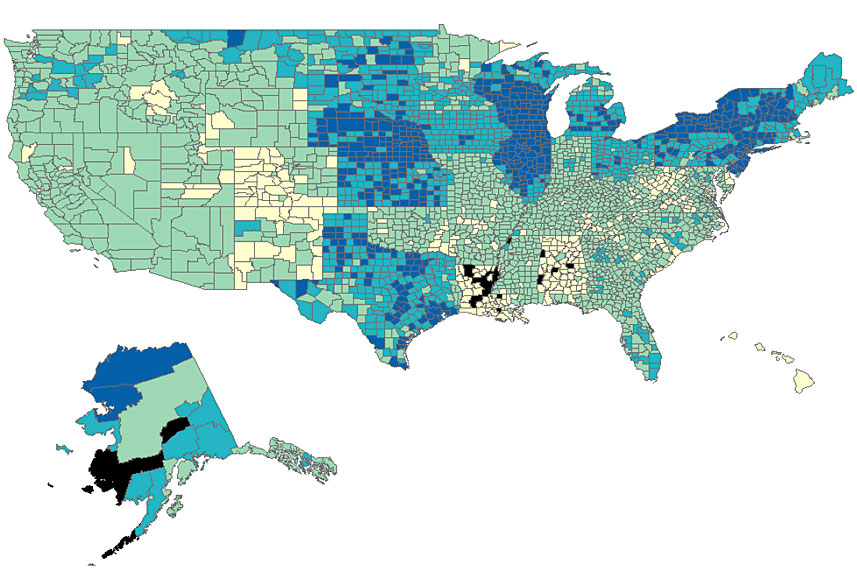

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Traditional Investments Vs Airbnb Investments Infographic Investing Rental Property Investment Real Estate Infographic

Property Taxes By State In 2022 A Complete Rundown

New York Property Tax Calculator 2020 Empire Center For Public Policy

How Property Tax Rates Vary Across And Within Counties Eye On Housing

State Local Property Tax Collections Per Capita Tax Foundation

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine

Property Tax Comparison By State For Cross State Businesses

Investment Income Is Money Earned By Your Financial Assets Or Accounts And Understanding How It Works Can Help Maximize Your Profits Capital Gain Capital Gains Tax Dividend

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Property Taxes By State Embrace Higher Property Taxes

Bergen County Tax Rates For 2018 2019 Michael Shetler

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)